Church Loans

A beacon of hope and light to a world in need. A place where people can comfortably gather for prayer and worship. Joy on the faces of children as they enjoy new playground equipment. A favorable impression made with each new visitor.

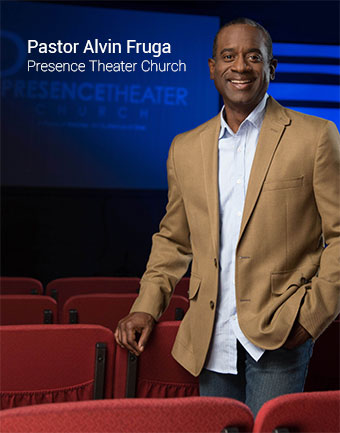

There is a feeling of pride in owning your own facility, and there is nothing we would rather do than help pastors and churches obtain the facilities for carrying out their ministry. A church dedication service is a thrilling experience, but it takes a lot of planning and work to get to that point. Laying the proper groundwork for the project is as important as the day the doors first swing open.

Since 1962, First Bank of Owasso has placed its faith in churches and faith-based organizations. Many of our directors, officers and employees serve as church elders, deacons, trustees, board members, treasurers, Sunday school teachers and ministry leaders.

Let's face it. You have the right to obtain financial services wherever you want. But ask yourself "does my bank add value to my ministry?"

We are able to help your church or ministry acquire the land or facilities necessary to carry out your ministry. Because all of our loans are retained and serviced by us, we can customize a loan to fit your needs. Exactly.

Sometimes you may need an interest-only loan for a period of time while capital campaign pledges are being paid. We can take care of that!

What about a bridge loan to acquire a new facility while marketing an existing building for sale? No problem.

We have years of experience in assisting churches with new construction and remodeling projects. We are often able to loan 100% of new construction costs. Every church construction project is different, and we can customize a loan to fit you.

Need an interest-only repayment period for a while? We can accommodate that.

Need a one-time loan closing for both construction and the permanent loan? Consider it done.

Does your existing loan fit your current needs?

Is the interest rate and repayment term in line with your current financial position?

Consider this: What might have been a good deal a few years ago may not be appropriate or competitive today. Let us look and see if we can help. We recently refinanced a loan for a private school and saved them over $15,000 per year in interest expense. That's real money.

Would you like to complete a Loan Referral Information form? It's quick, easy, and secure.