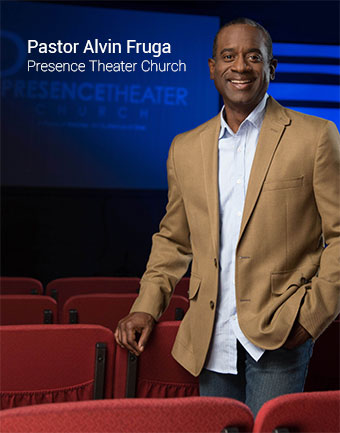

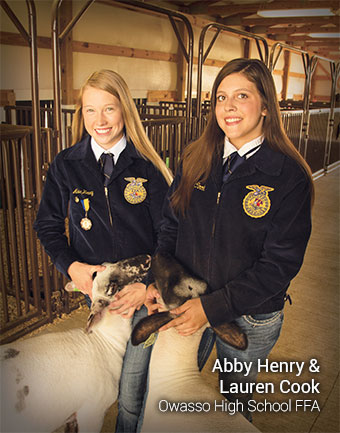

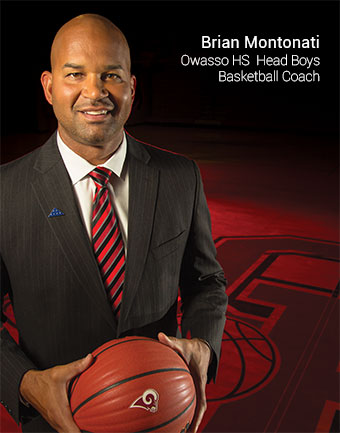

Church Deposit Accounts

We are pleased to offer a variety of deposit accounts. Businesses and churches work similarly when it comes to managing finances. Stewardship is wise and necessary. We offer these types of accounts for churches.

- Checking

- Money Market

- Savings

Are you ready to open an account?

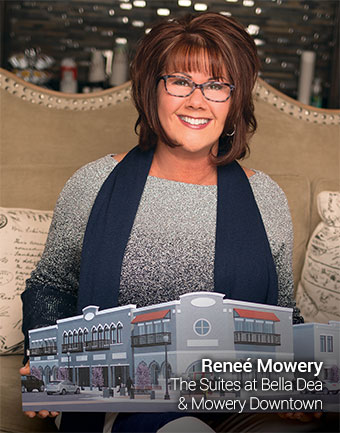

Business Checking

| Totally Free | |

|---|---|

| Best For | A small business, non-profit organization, local association, group or club |

| Minimum to Open | $100 |

| Earns Interest | No |

| Monthly Maintenance Fees | None |

| Online Banking | Free |

| Online Statements | Free |

| Business Debit Card | Free |

| Apple Pay, Google Pay, and Samsung Pay | Available |

| 24-hour Automated Client Service Line | Included |

| Additional Fees | $1.50 per thousand after first $10,000 deposited $.25 per transaction after first 300 |

| Advanced | |

|---|---|

| Best For | Any business with large monthly transaction volumes, higher balances and more complex banking needs (large cash deposits, change orders, etc.) |

| Minimum to Open | $100 |

| Earns Interest | No |

| Monthly Maintenance Fees | Offset account-related fees with a credit allowance based on average collected balance |

| Online Banking | Free |

| Online Statements | Free |

| Business Debit Card | Free |

| Apple Pay, Google Pay, and Samsung Pay | Available |

| 24-hour Automated Client Service Line | Included |

| Key Features | Monthly Analysis Statements enhance your ability to track business activities, such as payroll, savings, daily operations and risk management |

| Additional Fees | $.15 per deposit $.15 per check $.08 per transit item $.35 per currency strap $.10 per coin roll |

| Interest | |

|---|---|

| Best For | Some small businesses, sole proprietorships, public/government entities or non-profit organizations with larger balances |

| Minimum to Open | $1,000 |

| Earns Interest | Yes |

| Monthly Maintenance Fees | $6 fee if minimum daily balance drops below $1,000 |

| Online Banking | Free |

| Online Statements | Free |

| Business Debit Card | Free |

| Apple Pay, Google Pay, and Samsung Pay | Available |

| 24-hour Automated Client Service Line | Included |

| Additional Fees | $.15 per deposit $.15 per check $.10 per transit item deposited |

Business Money Market

| Premium | |

|---|---|

| Best For | Businesses that want to earn a premium interest rate |

| Minimum to Open | $2,500 |

| Earns Interest | Yes |

| Monthly Maintenance Fees | $10 monthly fee if average balance drops below $2,500 |

| Online Banking | Free |

| Online Statements | Free |

| Business Debit Card | Free |

| 24-hour Automated Client Service Line | Included |

| Key Features |

Tiered money market account

Rate may fluctuate with market rate |

| Advantage Money Market | |

|---|---|

| Best For | Treasury Service clients and/or large church depositors that want to take advantage of competitive higher yield interest rates. |

| Minimum to Open | $500,000 |

| Earns Interest | Yes |

| Monthly Maintenance Fees | $15 monthly fee if average balance drops below $500,000 |

| Online Banking | Free |

| Online Statements | Free |

| 24-hour Automated Client Service Line | Included |

| Additional Fees | $5 fee for each withdrawal in excess of six per month |

| Key Features | Tiered money market account *Rate may fluctuate with T-bill rate |

Business Savings

| Commercial | |

|---|---|

| Minimum to Open | $100 |

| Earns Interest | Yes |

| Online Banking | Free |

| Online Statements | Free |

| Business ATM Card | Free |

| 24-hour Automated Client Service Line | Included |

| Minimum Balance | $100 average balance per quarter |

| Key Features | Interest compounded daily and paid quarterly First six withdrawals per quarter free |

| Fees | $3 quarterly fee if average balance drops below $100 $1 fee for each withdrawal in excess of six per quarter |

*Denotes account types that can be opened online.